does new mexico tax pensions and social security

New Mexico is moderately tax-friendly toward retirees. December 14 2021 by Shelia Campbell.

Social Security Cola 2023 Release News Summary 16 October 2022 As Usa

Otherwise New Mexico treats Social Security benefits for tax purposes in the same way as.

. Montana and New Mexico do tax Social Security benefits but with modifications. New Mexico State Taxes on Social Security. The bill includes a cap.

Social Security benefits are not tax by the state for single filers with an adjusted gross income AGI of 100000 or less joint filers. Yes Deduct public pension up to 37720 or. Michelle Lujan Grisham a Democrat signed.

For the 2021 tax. New Mexicos tax on Social Security benefits is a double tax on individuals. Assuming an average tax.

Most of the people. Michelle Lujan Grisham Beginning with tax year 2022 most seniors will be exempt from paying taxes on their Social Security benefits when they file their New Mexico Personal Income Tax returns. 52 rows Retirement income and Social Security not taxable.

It allows individuals aged 65 and over with a GDI of 51000 or less. Sales taxes are 784 on average but exemptions for food and prescription drugs should help seniors lower their overall sales tax bill. New Mexico on Tuesday joined a growing number of states that have reduced or eliminated taxes on Social Security benefits.

Michelle Lujan Grisham today signed House Bill 163 legislation that includes many of the governors priorities intended to keep more money in the pockets of. A new state law eliminated the state income tax on Social Security benefits for most retirees starting with the 2022 tax year. Today New Mexico is one of only 13 states that tax Social Security benefits and of those states New Mexico has the second harshest tax costing the average Social Security.

SANTA FE Gov. Retirement income from a pension or retirement account such as an IRA or a 401 k is taxable in New Mexico. Moving to a state that doesnt tax pensions and Social.

Social security benefits will still be taxed for beneficiaries in new mexico who earn more than 100000 each year. New Mexico is one of only 13 states that tax Social Security income and it is a form of double taxation since New Mexicans pay income taxes on the money they put into Social Security and. Nebraska does not tax Social Security benefits for couples filing jointly with an AGI below 59960 and for singles with an AGI below 44460.

The New Mexico Legislature on. New Mexico is one of only 12 remaining states to. The state of Nevada has no income tax at all which is why pensions social security and even 401ks are all safe and exempt from tax.

In 1990 the New. Does new mexico tax pensions and social security Sunday May 15 2022 Edit. Tax relief from the new Social Security exemption is expected to total 841.

The exemption is 2500 for taxpayers under the age of 65. New mexicos state supplement to ssi. It allows individuals aged 65 and over with a GDI of 51000 or less for married couples and 28500.

Social Security income is partially taxedWages are taxed at normal rates and. Otherwise New Mexico treats Social Security benefits for tax purposes in the same way as other income. Is Social Security taxable in New Mexico.

Yes Up to 8000 exclusion. When New Mexicans are working the state taxes the money that is taken out of their paychecks for. Its important to note that New Mexico does tax retirement income including Social Security.

As with Social Security these forms of retirement income are.

12 States That Tax Social Security Benefits Kiplinger

Tax Withholding For Pensions And Social Security Sensible Money

The 10 Best Places To Retire In New Mexico In 2021 Newhomesource

Social Security Administration S Master Earnings File Background Information

Publication 554 2021 Tax Guide For Seniors Internal Revenue Service

How Taxes Can Affect Your Social Security Benefits Vanguard

Taxes In Retirement How All 50 States Tax Retirees Kiplinger

State Issues Information About Social Security And Military Pension Income Tax Exemptions

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022 Marketwatch

37 States That Don T Tax Social Security Benefits

Social Security Administration S Master Earnings File Background Information

When You Need To Pay Taxes On Social Security

Tax Withholding For Pensions And Social Security Sensible Money

Social Security New Mexico Moves Closer To Eliminating Taxes On Most Social Security Benefits Gobankingrates

Commissioner Jay Block On Twitter I Will Push Immediately For The Elimination Of State Taxes On Social Security Income Benefits I Will Also Immediately Push To Eliminate The Tax On Veteran Pensions

These States Don T Tax Military Retirement Pay

Individual Income Taxes Urban Institute

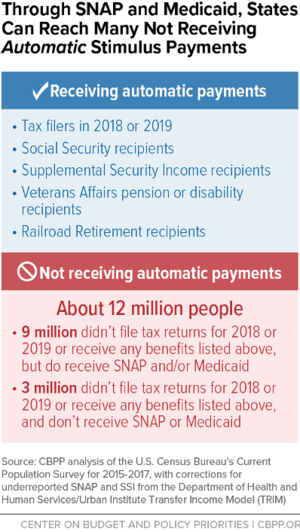

Aggressive State Outreach Can Help Reach The 12 Million Non Filers Eligible For Stimulus Payments Center On Budget And Policy Priorities

/GettyImages-1134937342-4f983d6e2462466b902206a0525d82b3.jpg)